无论您走到哪里,都可以带着ACFCU!有了网上和手机银行,您可以随时随地访问您的账户。

Push To Pay

Pay quickly and securely with your mobile wallet.

We’ve made it even easier and more secure to shop in-store, dine out, or visit your favorite entertainment venue. Say goodbye to scrambling for your wallet at the checkout line. Just add your ACFCU Visa® credit or debit card to your mobile wallet and you can make quick payments without cash or the cards themselves.

How To Add Your Card To Your Mobile Wallet:

- Log into the Mobile App.

- 点击进入 Card Controls.

- Select your card.

- Swipe down until you see Add to G Pay or Apple Pay.

Why Should I Use My Mobile Wallet?

Using a mobile wallet streamlines your payment processes, adds an extra layer of security, and provides much more convenience. You don’t need to wait for your plastic card to come in the mail to add it to your mobile wallet. Don’t use a mobile wallet? No problem! You can easily view your card details whenever you want—your card number, expiration date, and CVV code are all in Online and Mobile Banking. If you do use a mobile wallet, you can easily load your card into your wallet without the hassle of manual entry. When you use your credit or debit card to make a purchase, the mobile wallet applies a random identification number to your purchase instead of providing your credit card information. This makes it harder for scammers to access your personal and financial information.

Enroll in Electronic Statements

Ready to reduce your carbon footprint?

Have the power to access your current or previous statements whenever and wherever you want. We make it simple with electronic statements.

How To Enroll In Electronic Statements:

- Log into your online banking account from your computer and go to Notifications

- 点击进入 电子文件

- 点击进入 概述

- 点击进入 Gear Wheel

- 选择 订阅

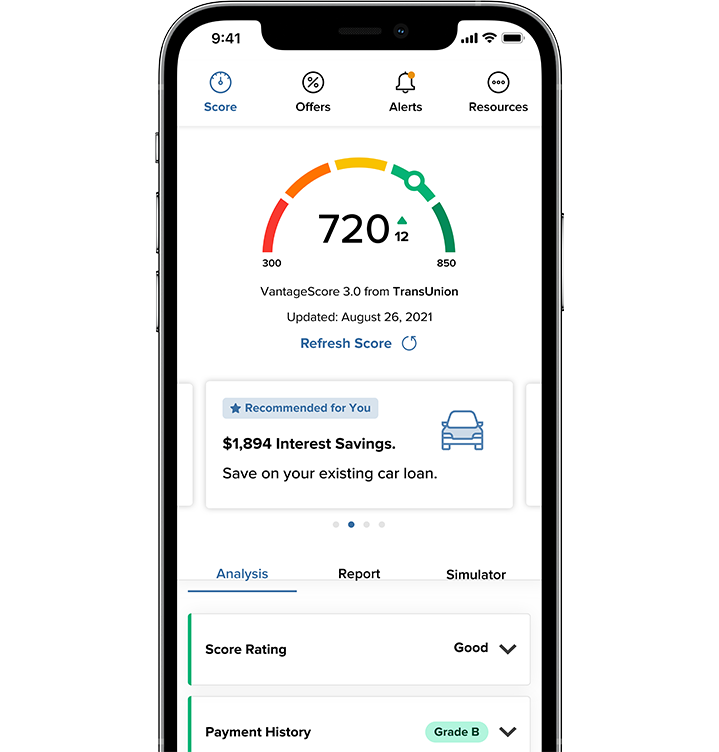

Credit Score

Powered by SavvyMoney.

Check your credit score for free at any time with Credit Score by Savvy Money. Easily sign up and receive notifications on score changes, special offers, and financial tips.

How To Get Started:

- Log into the ACFCU Mobile App 或 网上银行

- 选择 财务健康 icon

- 选择 Credit Score

- Sign up and enjoy access to your credit score, credit reports, financial education, and more

- Daily access to your credit score

- Real time credit monitoring alerts

- Personalized credit report

- Credit score simulator

账单支付

管理你的账单,节省时间和金钱。

在线和手机银行账单支付,通过直接从您的ACFCU支票账户中定制自动付款,让您不再为支付每月账单而烦恼。2

- 方便、轻松、安全地支付账单

- 100%付款保证

- 安排一次性、经常性、当日或次日的付款

Digital Banking

更大的财务控制权就在你的指尖。

With Arlington Community FCU’s mobile app and online banking, you can view transactions, balances and checks, manage credit and debit cards, update your contact information, and much more. It’s easy to set up and quickly get increased convenience and account security.

- 快速、安全、可靠地管理您的所有银行业务

- 支付账单, loans, and your ACFCU credit card

- 转移资金 内部、外部和其他阿灵顿成员的账户之间的关系

- 发送安全信息,访问 通知和电子结单 并建立预算和储蓄目标*。

- 设置卡片警报和卡片控制:根据需要阻止和解除卡片,阻止国际交易,对签名、密码、ATM交易设置美元金额限制,以及通过卡片管理小部件进行更多的设置。

- 管理您的ACFCU借记卡,查看您离获得现金返还支票账户奖励的资格有多远1

- 访问您的ACFCU信用卡,查看奖励,进行现金预支,付款,封锁您的卡片和 将其他信用卡余额转到您的ACFCU信用卡上

- 以较低的费用停止付款,要求国内电汇,并订购支票

- 查看非Arlington账户的账户信息

- Monitor your credit report and get financial tips with SavvyMoney

- Link internal and external accounts

- Use Password managers

- Use Authentication Apps

Plus on the Mobile App:

- 使用智能手机的摄像头用移动存款存入支票3

- 使用 移动钱包 在参与活动的地点用你的借记卡或信用卡付款

- 经由下载 Apple App Store ® 或 Google PlayTM

移动钱包

进行非接触式消费。

当您使用ACFCU的移动钱包用Apple Pay支付时,把钱包留在家里,享受安全、非接触式的购买体验。®, 谷歌支付TM,或三星® 支付。 现在就了解如何访问和使用你的移动钱包.3

- Use your phone to pay as you go about your day with Mobile Wallet for your ACFCU Visa® 借记卡和信用卡*。

- 非接触式、安全和可靠的购买,无论你是在网上、应用程序中还是在商店里通过在支付终端上轻触你的设备来使用它。

- 在商店和餐馆赚取与实体卡一样的奖励。4

电子文件

以数字方式接收文件。

在一个地方获取报表、通知和税务文件。再也不用去寻找ACFCU的文件了。

- 在网上查阅你的报表--一旦有了这些报表,就可以查阅以前的报表,最远可追溯到24个月前。

- 电子月结单帮助你获得以下资格 免费奖励支票 r奖励

- 通过电子通知接收证书到期、逾期贷款付款和年终税务文件

透支保护

Create peace of mind with Courtesy Pay, which acts like insurance against overdraft fees for your checking account.

无论你是高估了你的账户余额,还是在审查总额之前刷了你的借记卡,我们都提供保险来保护你的账户。

礼节性支付包括以下类型的交易。4

- 使用支票账户进行的支票、ACH和其他交易

- 自动支付账单

- 使用你的借记卡设置的重复交易

- ATM交易

- 日常借记卡交易

- 销售点(POS)交易

我们的$30宽限意味着如果你的透支余额少于$30,借记卡交易就不收费。5

在任何时候,只要你愿意,都可以使用我们的礼节性支付小工具实时选择加入和退出。

如何选择加入和退出礼节性支付。

- 登录移动应用程序或网上银行

- 点击更多

- 点击礼节性支付

*数据和运营商费率可能适用。

1Cash back is calculated based on the total dollar amount of qualifying debit card transactions. Account will not be dividend bearing. 1% cash back on first $1,000 in transactions. Maximum cash back is $10. For minimum requirements to be met, actions must be performed and must clear/post to the account during the qualification period. Transactions may take one or more banking days from the date the transaction was made to post and settle against your account. Swipe & Sign, PIN, and Debit Bill Pay transactions must have cleared account by the end of the month. Standard fees will apply such as an account that has been inactive for longer than 12 months. No overdraft fees for debit card transactions that overdraw by less than $30. This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged. Overdraft fees must be repaid within 45 days. A $30 fee is charged for each occurrence. Courtesy Pay will not be paid if Courtesy Pay is disabled and the transaction is declined. In those cases, an NSF fee will be charged. Courtesy Pay covers the following types of transactions: checks, ACH, and other transactions made using a checking account, automatic bill payments, recurring transactions set up using your debit card, ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions. ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions require separate opt-in.

2如果你的账户里没有足够的钱,你将被收取每张支票的资金不足费。

3手机存款需经核实,最高可提取$200。你的账户必须信誉良好;不能有一个信誉不良的账户,不能有ChexSystems的负面记录,也不能有任何超过30天的拖欠贷款。请阅读《电子资金转账协议和披露》(Reg E),了解包括资金可用性、存款限额、支票的正确处置以及完整的条款和条件等细节。

4ATM交易、日常借记卡交易和销售点(POS)交易需要单独选择。

5 Overdraft fees must be repaid within 45 days. A $30 fee is charged for each occurrence. This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged.

苹果、苹果标志、iPhone和iPad是苹果公司的商标,在美国和其他国家注册。App Store是苹果公司的服务商标。安卓是谷歌公司的商标。 ©2019年谷歌公司。保留所有权利。Google Pay是Google LLC的商标。Samsung Pay是Samsung Electronics Co., Ltd.的注册商标。查看接受Samsung Pay的商店的完整列表,请登录www.Samsung.com/pay。可能需要支付数据费用。

为了保护您,我们使用最新的加密标准,因此支持以下浏览器和操作系统的最新两个版本。谷歌浏览器、火狐、微软Edge、Safari、iOS。我们支持Android v5.0及以上版本,并对Internet Explorer v11提供有限支持。虽然我们确实在监测欺诈或可疑活动,并可能主动与您联系,但我们绝不会打电话要求提供保密信息,如您的整个账户号码或密码。请联系我们。703.526.0200 x4 如果您提供了保密信息。

由NCUA提供联邦保险。会员资格要求适用。